sales tax wichita ks 2016

Wichita County in Kansas has a tax rate of 85 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Wichita County totaling 2. The Wichita County sales tax rate is.

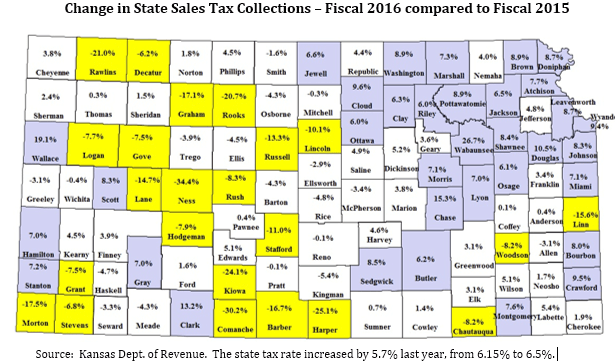

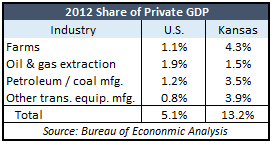

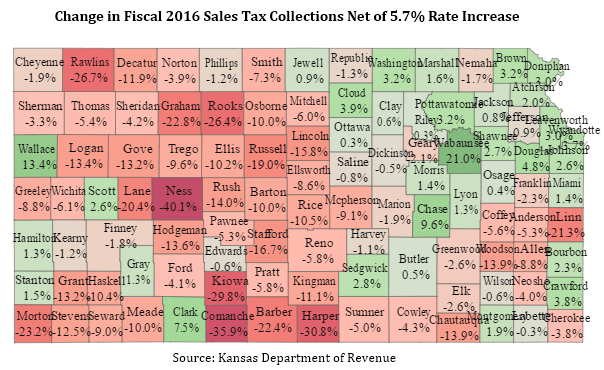

Oil Farming Suppress Sales Tax Collections Kansas Policy Institute

Local sales taxes are collected in 38 states.

. As your wichita small business accountant we. The Wichita County Sales Tax is collected by the merchant on all qualifying sales made within Wichita County. You can find more tax rates and allowances for Wichita County and Kansas in the 2022 Kansas Tax Tables.

The december 2020 total local sales tax rate was also 7500. Food Sales Tax Credit multiply line G by 125. Kansas views on tax shortfall hopes for 2016 food sales tax Medicaid expansion The Wichita Eagle.

Wichita County collects a 2 local sales tax the maximum local sales tax. Sales tax rates differ by state but sales tax bases also impact how much revenue. Wichita Details Wichita KS is in Sedgwick County.

The minimum combined 2022 sales tax rate for Wichita Kansas is. Topeka KS Sales Tax Rate. The Wichita sales tax rate is.

There is no applicable city tax or special tax. The Sedgwick County Kansas sales tax is 750 consisting of 650 Kansas state sales tax and 100 Sedgwick County local sales taxesThe local sales tax consists of a 100 county sales tax. Name or address has changed.

The five states with the highest average combined state and local sales tax rates are Louisiana 999 percent Tennessee 945 percent Arkansas 930 percent Alabama 897 percent and Washington 892 percent. The latest sales tax rates for cities in Kansas KS state. The 2018 United States Supreme Court decision in South Dakota v.

Interactive Tax Map Unlimited Use. Has impacted many state nexus laws and sales tax collection requirements. 1105 E 1st St Pratt.

View sales history tax history home value estimates and overhead views. See reviews photos directions phone numbers and more for Sales Tax locations in Wichita KS. Sales tax wichita ks 2016 Sunday March 13 2022 Edit Odometer is 4414 miles below market average2016 Versa Note Nissan S FWD 5-Speed Manual 16L 4-Cylinder DOHC 16V2736 CityHighway MPG15 Steel Wheels wFull Wheel Covers 4 Speakers ABS brakes Air Conditioning AMFM radio AMFMCD Audio System Brake assist Bumpers.

Elite Auto Sales - Wichita KS. Apply to Accounts Payable Clerk Office Manager Tax Manager and more. This is the total of state county and city sales tax rates.

3 lower than the maximum sales tax in KS. The current total local sales tax rate in Wichita KS is 7500. Kansas Income Tax Kansas Dept.

Wichita is located within Sedgwick County Kansas. 2020 rates included for use while preparing your income tax deduction. KANSAS INDIVIDUAL INCOME TAX.

The current total local sales tax rate in wichita ks is 7500. See reviews photos directions phone numbers and more for Kansas Sales Tax locations in Wichita KS. This rate is the sum of the state county and city tax rates outlined below.

Estimate your monthly payment for this vehicle. Within Wichita there are around 32 zip codes with the most populous zip code being 67212. Local tax rates in kansas range from 0 to 41 making the sales tax range in kansas 65 to 106.

If you have any questions regarding sales tax exemption please contact Loretta Knott at LKnottwichitagov or by phone at 316-268-4636. Come see us at 5505 E Kellogg Dr Wichita KS 67218 or call us at 316-260-4418. The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax and 200 Wichita County local sales taxesThe local sales tax consists of a 200 county sales tax.

On Tuesday morning the Wichita City Council approved the first reading of an ordinance to drop the Community Improvement District CID. Automating sales tax compliance can help your business keep compliant with changing sales. The sales tax rate does not vary based on zip code.

Wichita KS Sales Tax Rate. The Kansas sales tax rate is currently. Lower sales tax than 73 of Kansas localities.

The County sales tax rate is. The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax. Ad Lookup Sales Tax Rates For Free.

Inventory All Inventory Edmunds Trade-In. The Sedgwick County Sales Tax is collected by the merchant on all qualifying sales made within Sedgwick County. 2020 rates included for use while preparing your income tax deduction.

House located at 10615 W Yosemite Dr Wichita KS 67215. PO Box 750260 Topeka KS 666. Sedgwick County collects a 1 local sales tax the maximum local.

2 beds 3 baths 1962 sq. Enter the result here and on line 17 of this form. In 2022 the minimum combined sales tax rate within Wichita Kansas 67202 zip codes is 75.

To review the rules in Kansas visit our state-by-state guide. Elite Auto Sales - 2016 Honda Pilot Elite - Used Cars and Trucks Near Wichita. Pricing does not include sales tax dealer documentation fee title fee license fees service contracts ancillary products or any finance.

The average cumulative sales tax rate in Wichita Kansas is 75. Rates include state county and city taxes. The December 2020 total local sales tax rate was also 7500.

This includes the sales tax rates on the state county city and special levels. What is the sales tax rate in Wichita Kansas. Since last year mark an X in this box.

You can print a 75 sales tax table here.

Tax Cuts And The Kansas Economy Kansas Policy Institute

/cloudfront-us-east-1.images.arcpublishing.com/gray/2YXRYZQZPND75FXD5B677KCNBM.jpg)

Homeowners Across Sedgwick County Likely To See Rise In Property Taxes

Institute For Policy Social Research

Used Nissan Altima For Sale In Wichita Ks Cars Com

My Local Taxes Sedgwick County Kansas

File Sales Tax By County Webp Wikimedia Commons

Study Kansas Sales Tax Pushes Shoppers Across State Line Kansas Health Institute

Institute For Policy Social Research

Which Counties Pay The Most Taxes In Kansas You Ve Probably Guessed Correctly Wichita Business Journal

Schmidt Kelly Ring Up Intriguing Campaign Narratives About Kansas Sales Tax Rate Kansas Reflector

Institute For Policy Social Research

Study Kansas Sales Tax Pushes Shoppers Across State Line Kansas Health Institute

Convertible For Sale In Wichita Ks Payday Motors

Oil Farming Suppress Sales Tax Collections Kansas Policy Institute